Fixed index Annuities

Fixed Index Annuities

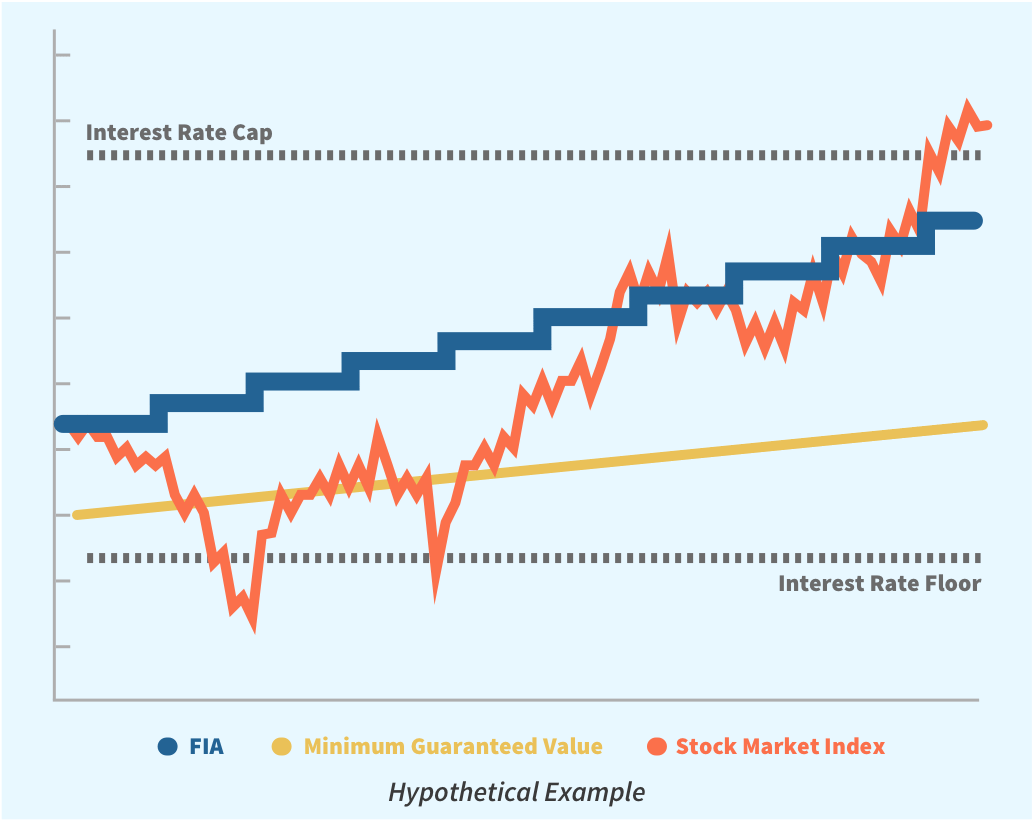

Eliminate Market Risk

Fixed Index Annuities can be a very important part of Your Investment Strategy. They allow you to participate in only the gains of the underlying index and never the losses over your time period, usually one or two years. If the index goes down for your time period you will get zero instead of the loss. This allows you to participate in only the gains of Index's like The Atlas 5 Index, Smart Passage SG Index, Franklin U.S. Index, the Blackrock iBLD Diversa VC 7 ER index, and many others depending on what product is right for you and your time frame. The products we look for have zero to very low fees unlike Variable Annuities that are generally high in fees and do not eliminate market risk, for this reason we do not like Variable annuities. Before considering any Index Annuity you must address your liquidity risk. Important terms that need to be understood are participation rates, caps, spreads, and others. Please speak with your financial advisor before purchasing any Annuity product and make sure you understand the product completely before making any decisions. Not all Index Annuities are the same.